Düsseldorf Office Rental Market 2023

Moderate decline in take-up, investment market shows limited transaction activity

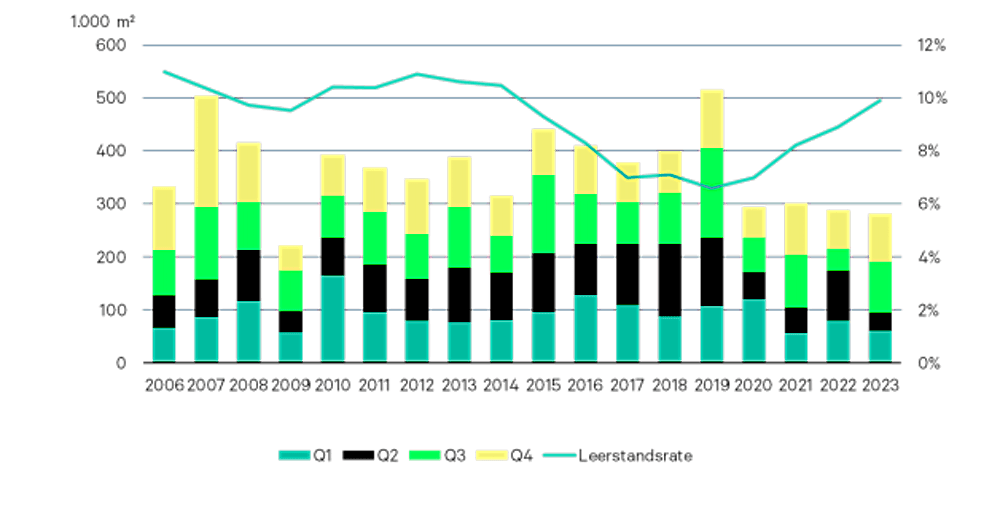

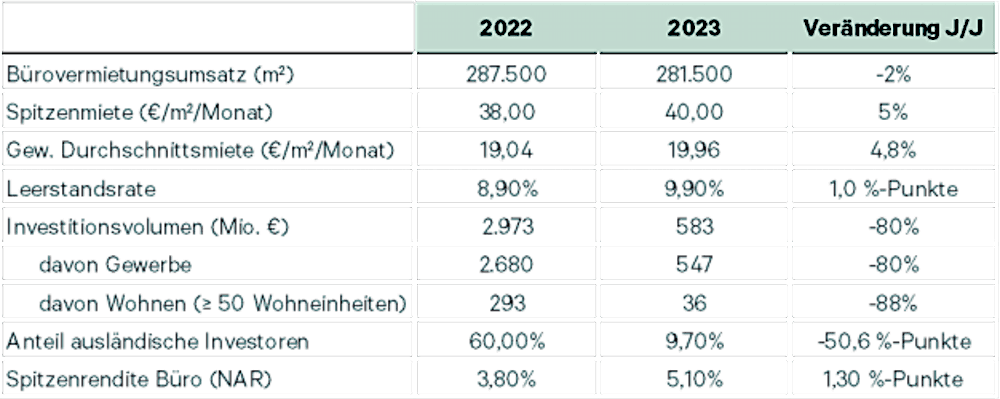

Düsseldorf's office rental market (covering Düsseldorf, Ratingen, Hilden, Erkrath and Neuss) recorded 281,500 square metres of take-up in 2023—a two per cent decline year-over-year. Within Düsseldorf proper, take-up dropped to 250,000 square metres. The investment market faced steeper headwinds, with transaction volumes reaching just €583 million for the full year, down 80 per cent from 2022. The final quarter proved the second strongest, bringing in just under €96 million and outpacing Q3 by 14 per cent. Beyond this, minority stakes worth approximately €130 million changed hands throughout the year, though these fall outside official transaction figures. So reveals a fresh analysis from global real estate services provider CBRE. "Year-end brought notable market momentum," notes Simon Herlitz, Head of Office Leasing at CBRE Düsseldorf. "Yet despite widespread decisions to extend existing leases rather than relocate, office space turnover barely matched the prior year's levels." The strength came from the second half, which generated 187,000 square metres of take-up, bolstered by several major deals.

Rental growth accelerated across high-value deals, particularly in the CBD. Prime rents remained steady quarter-over-quarter at €40.00 per square metre per month, while climbing 5 per cent year-over-year to €2.00 per square metre above 2022 levels. The weighted average rent rose to €19.96 per square metre per month over the same period, though recent large-scale lettings in peripheral zones have slightly pulled this figure down. Notably, the Kennedydamm, CBD, and Nord submarkets all saw quarter-over-quarter increases in weighted average rents. Looking exclusively at Düsseldorf's city centre, weighted average rents jumped from €19.45 to €20.96 per square metre per month.

Occupiers increasingly prioritize premium-grade space to meet ESG standards and enable contemporary workplace strategies. This shift is reflected in 2023 figures: roughly 60 per cent of office leasing went to first-class facilities—split between newly developed projects (29 per cent of total volume) and refurbished stock. Düsseldorf's CBD maintained its position as a top-tier submarket, commanding over 15 per cent of total demand.

By year-end 2023, vacancy rates in the broader Düsseldorf market climbed to 9.9 per cent, while Düsseldorf city proper saw rates rise from 7.9 to 8.8 per cent. Short-term sublease availability swelled to just under 125,000 square metres—47 per cent higher than a year prior—concentrated mainly in the Grafenberg/Ost, Seestern and Kennedydamm submarkets. Office properties dominated investment activity throughout 2023, capturing 34 per cent of market volume. Warehouse and logistics assets followed closely with 29 per cent, including industrial parks like Areal Böhler. Retail made up the remaining 11 per cent. Looking to 2024, value-add and opportunistic strategies remain investor favorites, accounting for roughly 62 per cent of capital deployed toward properties with upside potential.

Prime yields for top-tier office buildings in Düsseldorf continue their upward trajectory, now breaching the five per cent threshold—mirroring trends across other leading markets. This marks a 2.35 percentage-point rise since Q1 2022's low point. City fringe locations command 5.45 per cent, while peripheral areas reach 6.10 per cent. Inner-city commercial properties showed more modest growth at 4.75 per cent quarter-over-quarter, while modern logistics assets achieved 4.30 per cent. Looking ahead to 2024, approximately 153,300 square metres of new or completely refurbished office space will enter the market, with roughly half already pre-leased as of end-2023.

www.cbre.de/standorte/duesseldorf

More News

under construction / public preposition

Exhibition at Baukunstarchiv NRW, Dortmund

Erich Mendelsohn Prize 2026 for Brick Architecture

Submissions now open